Abstract

Cryptocurrency (crypto) markets are among the most volatile and unpredictable financial environments, driven by 24/7 trading, fragmented liquidity, and extreme sensitivity to external events such as regulatory actions, technological shifts, and social media influence. Traditional forecasting and trading approaches, whether classical statistical or deep learning models, rule-based bots, or sentiment-driven systems, each offer unique strengths but suffer from critical weaknesses when deployed in isolation, such as overfitting to noise, rigidity in the face of market shifts, or vulnerability to false signals from sentiment data. This article introduces Hybrid Edge Trading Schema (HETS), a novel 7-layer approach to crypto forecasting and automated trading agents designed to mitigate these shortcomings.

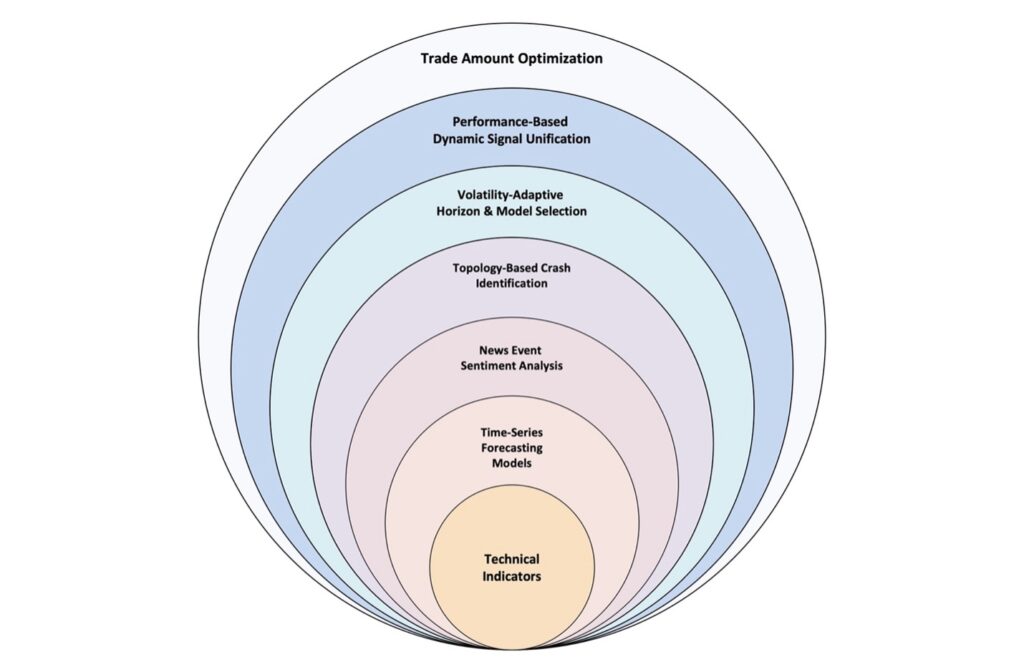

The idea integrates seven complementary layers of signal processing, strategy analysis, and decision-making, including topological market watch for early warnings of systemic downturns; real-time forecasting models to capture micro-patterns and momentum; event-driven sentiment analysis to embed qualitative market drivers; technical indicators to provide interpretability and trader context; volatility-adaptive model selection for market-aware flexibility; ensemble signal blending for consensus-driven reliability; and trade amount optimization to ensure disciplined, risk-adjusted execution. For investors, institutions, and researchers, this combinatorial approach offers a blueprint for trading systems that can thrive in the inherently noisy, speculative, and rapidly evolving crypto landscape. Collectively, these approaches establish a resilient, adaptive, and context-aware system, expected to produce more consistent profits while lowering drawdowns and mitigating the risks of sudden shocks.

Navigating Volatility: Challenges in Crypto Forecasting & Trading

Cryptocurrencies exhibit substantially higher price volatility than traditional assets such as stocks or broad indices. In the short term, Bitcoin’s price swings are nearly five times more extreme than those of the S&P 500, and even over the long haul, its volatility remains four times higher (Nzokem & Maposa, 2024). One study reported that the 1-month rolling volatility of Bitcoin was 24.1%, compared to only 4.2% for the S&P 500 and 5.1% for Nasdaq (Honerød-Bentsen & Knutli, 2023). Even when viewed on a risk-adjusted basis, crypto returns differ. Bitcoin’s annualized Sharpe ratio (approximately 0.8) has been nearly double that of the S&P 500 in several analyses (Almeida, Grith, Miftachov, & Wang, 2024). In other words, crypto markets are far noisier yet have historically offered higher risk-adjusted returns. The magnitude of these standard deviations and swings underscores the volatility of crypto assets as compared to traditional financial assets. This volatility is magnified by crypto’s heightened sensitivity to external factors.

The cryptocurrency markets therefore present a uniquely difficult environment for forecasting and trading. They are not only inherently volatile and trade 24/7/365, they are also subject to external shocks. Unlike traditional equities, where volatility is comparatively contained, Bitcoin and other digital assets frequently experience sharp spikes and crashes triggered by socio-economic changes, technological advances, and cultural events. For example, on January 29, 2021, Bitcoin surged nearly 20% within hours after Elon Musk added “#bitcoin” to his Twitter bio (CNBC, 2021). The collapse of FTX in November 2022 sent ripples across the digital asset world, sparking a rapid and widespread sell-off. Over a span of three days, the combined value of 15 major cryptocurrencies plummeted by $152 billion. Bitcoin was hit especially hard, tumbling 16% and falling to levels last seen in late 2020. (Khan, Khurshid, & Cifuentes-Faura, 2025). Such unexpected events, whether stemming from celebrity tweets, breaking news, or exchange failures, can trigger sudden double-digit swings.

Such dynamics reveal how sentiment and speculative behavior drive short-term deviations from fundamentals (Sattarov & Makhmudov, 2025; Lupu & Donoiu, 2025). Hype cycles on media, sudden legal interventions, and even social memes can rapidly inflate or deflate valuations. These conditions render historical patterns less reliable and highlight the limitations of conventional financial models designed for more stable markets. They also underscore the urgent need for adaptive and robust forecasting mechanisms capable of integrating heterogeneous signals and remaining resilient to unpredictable market shifts.

Traditional Forecasting Approaches and Limitations

In recent years, a variety of approaches have emerged to tackle the crypto forecasting challenges, each addressing problems from different angles. However, no single method addresses the multitude of challenges. Below includes the review and analysis of the three major solution categories traditionally adopted in crypto forecasting: deep learning models, rule-based trading bots, and sentiment analysis systems.

- Machine Learning Models for Forecasting: Advanced machine learning techniques, especially deep neural networks, have been applied to crypto price trend predictions. Recurrent Neural Networks (RNNs) and Long Short-Term Memory (LSTM) models can capture complex nonlinear patterns in historical price data, often outperforming traditional statistical models such as Autoregressive Integrated Moving Average (ARIMA) or Generalized Autoregressive Conditional Heteroscedasticity (GARCH) in predictive accuracy (Sattarov & Makhmudov, 2025). Recent studies have also explored Transformer-based architectures in combination with other models, reporting improved prediction performance by managing the complexities of crypto markets. The appeal of deep learning lies in its ability to handle large, noisy datasets and detect subtle temporal correlations without assuming stationarity. However, these models are not without drawbacks. They typically require vast amounts of data and careful tuning to avoid overfitting to past trends (Bourday, Aatouchi, Kerroum, & Zaaouat, 2024). Moreover, their predictive logic is often a “black box,” making it unfeasible for humans to interpret or trust the reasoning behind results. If market conditions shift dramatically (e.g., a new type of crisis or a structural break not seen in training data), a static trained model may struggle to adapt quickly. In short, deep learning predictors provide powerful pattern recognition but lack transparency and contextual awareness, particularly with respect to exogenous shocks such as breaking news or regulatory interventions.

- Rule-Based Trading Bots: These are automated trading systems programmed with fixed if-then rules or technical indicator strategies. Such bots can execute trades with superhuman speed and discipline. For example, arbitrage bots can exploit price differences across exchanges, or trend-following bots can buy when prices move above a moving average and sell when prices fall below a particular threshold (Cointelegraph, 2025). Rule-based bots excel at 24/7 vigilance and consistency, never deviating from their programmed strategy due to fear or greed. This makes them effective for repetitive tasks such as market-making as a large portion of crypto trading volume is handled by algorithmic bots. The major limitation, however, is rigidity. These bots adhere strictly to predefined rules and, unless a human reprograms their logic, struggle to adapt to sudden market volatility or unexpected events (e.g., a flash crash or a tweet from a major influencer) (Cointelegraph, 2025). They also lack contextual understanding. A traditional bot has no awareness of why the market is moving. As a result, a rule-based strategy that works well in one market condition may fail disastrously when conditions change. Without adaptive mechanisms, rule-based bots are vulnerable in the highly dynamic crypto environment, often being blindsided by scenarios outside their programmed rules.

- Market Sentiment Analysis: Another approach leverages the collective mood of the market, using data from news feeds, social media (Twitter, Reddit), and other sentiment indicators to inform trading decisions. This approach is motivated by ample evidence that cryptocurrencies are strongly influenced by public sentiment. For instance, studies have shown that Bitcoin and other digital assets react significantly to sentiment expressed on Twitter by key figures, with trading volumes and volatility shifting in response to positive or negative tweets. Similarly, sentiment extracted from news headlines can drive cross-crypto volatility. By monitoring sentiment in real time, trading systems aim to anticipate bullish or bearish waves that are missed by technical models. Such systems can sometimes capitalize on early signs of FUD (fear, uncertainty, doubt) or hype before the price fully adjusts. On the downside, sentiment-driven methods face challenges with signal quality. Social media and news data are noisy; not every tweet or article is relevant, and indiscriminate analysis can introduce noise and false signals (Lupu & Donoiu, 2025). There is also a concern about the lag between signal and analysis. By the time sentiment indicators flash warning of a crash, prices may have already moved. In short, while sentiment analysis adds a fundamental dimension to crypto trading, relying on it alone can be risky without filtering and cross-validation with other data.

Motivation for a Novel Approach to Crypto Forecasting

With crypto markets operating around the clock, marked by wild price swings and an endless surge of news and social chatter, fixed models quickly lose relevance, and past trends offer little guidance. In response, researchers are pivoting toward more agile solutions, such as phase-switching techniques, reinforcement learning, and blended approaches, designed to adapt on the fly and navigate the market’s shifting tides and sudden disruptions. (Dote Pardo & Espinosa-Jaramillo, 2025). This has led to a growing consensus that a hybrid strategy, blending the precision of specialized trading approaches with the context-aware intelligence of broader AI capabilities, offers a more resilient path forward.

Approaches to Address the Challenges in Traditional Crypto Forecasting and Trading

The challenges outlined in this paper, ranging from extreme volatility to sensitivity and external events, demand innovative and adaptive solutions. Traditional crypto forecasting and trading methods often fall short in such an environment. However, research and industry practices offer a diverse set of strategies that can help mitigate these risks. This section reviews a 7-layer integrated approach designed to improve resilience, adaptability, and accuracy in crypto markets. Each approach tackles a specific aspect of uncertainty, from detecting early crash signals to optimizing trade allocation. These components together form HETS, providing a toolkit for building more robust forecasting and trading agents.

- Technical Indicators: Technical indicators remain foundational tools for traders and are heavily used in algorithmic trading strategies. Indicators such as moving averages, Bollinger Bands, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) help detect trend direction, volatility bands, and overbought or oversold conditions. More complex systems combine multiple indicators or integrate them into machine learning pipelines, where multiple indicator values serve as features to enhance predictive accuracy. However, indicators are prone to whipsaws in noisy markets and may yield conflicting signals, making over-reliance on a single rule problematic. The recommendation is to adopt a combinatorial approach where multiple indicators are blended to provide richer context, amplifying consensus and filtering out misleading moves. This not only improves predictive accuracy but also injects human interpretability into opaque AI-driven systems. In the hybrid framework, technical indicators function best as contextual anchors, providing transparency, interpretability, and complementary strengths that balance the black box nature of deep learning models (Deep et al., 2024).

- Time-Series Forecasting Models: A wide spectrum of methods exists for forecasting financial time series, ranging from classical statistical models to modern AI approaches. Traditional models such as ARIMA or exponential smoothing remain useful for short-term projections due to their speed and simplicity, but they struggle with the nonlinear patterns and shifts that dominate crypto markets (Sattarov & Makhmudov, 2025). Machine learning methods, including decision trees and ensemble algorithms, extend capability by detecting nonlinearities, while deep learning models such as LSTMs, Gated Recurrent Units (GRUs), and transformers excel at capturing sequential dependencies and complex temporal relationships (Bourday, Aatouchi, Kerroum, & Zaaouat, 2024). Streaming models and state-space approaches including Kalman filters further enable real-time adaptation, updating forecasts continuously with each new data point (Azman, Pathmanathan, & Thavaneswaran, 2022). This ability to generate minute-by-minute predictions allows the forecasting agent to immediately spot patterns and momentum shifts that human traders may overlook in a 24/7 market. Still, no single forecasting model is bulletproof, and high-frequency methods are especially prone to misinterpreting noise as signal. For this reason, real-time forecasting should be used as a short-horizon engine within a hybrid system, delivering responsiveness to micro-trends, reinforced by other layers such as event-driven signals and volatility-adaptive methods to ensure robustness. Lessons from high-frequency trading (HFT) and market microstructure research show that Order Flow Imbalance (OFI), order book depth, and liquidity shocks are among the strongest local predictors of short-term price moves (Easley, O’Hara, Yang, & Zhang, 2024; Anastasopoulos et al., 2024). Ignoring these features risks overlooking actionable microstructure signals. Incorporating OFI-based modules or embeddings could strengthen real-time crypto forecasting.

- News Event Sentiment Analysis: Given that crypto markets are uniquely sensitive to news and social media signals, event-driven models offer a crucial complement to price-based forecasting. Traditional Natural Language Processing (NLP) approaches to sentiment analysis, ranging from simple sentiment lexicons (VADER, TextBlob) to domain-trained models such as FinBERT, often missed nuance and context, especially in informal or fast-moving text (Lupu & Donoiu, 2025). The emergence of large language models (LLMs) has dramatically improved sentiment analysis by capturing deeper linguistic and contextual cues. This advancement is particularly important for event-driven forecasting, where shifts in sentiment, triggered by news, social media, or unexpected events, can rapidly impact markets. LLMs enable more accurate, real-time interpretation of these signals, enhancing the ability to anticipate and respond to sudden market movements. Events such as celebrity tweets or major exchange collapses have caused double-digit moves in hours, underscoring the value of this layer. The practical recommendation is to use sentiment both as a model input, enriching forecasts with contextual awareness, and as a standalone signal to confirm or challenge model predictions. This dual role improves responsiveness to shocks and reduces reliance on historical prices alone. The strongest value comes when accurate sentiment analysis is combined with technical and volatility-based layers to balance speed with stability.

- Topology-Based Crash Identification: Topological Data Analysis (TDA) has emerged as a novel tool for early crash detection and portfolio protection. By converting financial time series into “point clouds” and examining their geometric patterns, TDA methods can spot when a system is approaching a critical state, much like a phase change in physics. Such approaches extract topological features, such as persistent homology, which often act as early-warning signals that are more robust to noise than traditional indicators. In practice, TDA-based models (e.g., the open-source giotto-tda library) have issued clear warning peaks ahead of major crashes such as the dotcom bust and the 2008 financial crisis. Conventional models struggled with noisy and ambiguous signals (Tauzin et al., 2021). It is important to emphasize that this type of crash detection is not meant to forecast ordinary market fluctuations or day-to-day price moves. Instead, it should be treated as a safety net mechanism—an early-warning system that activates only when the topology of market data begins to resemble structural patterns from past crises. This mechanism acts like an automatic circuit-breaker or parachute: it may not trigger often, but when it does, it can preserve significant capital. By continuously evaluating crash signals and overall market health, the trading agent can pre-emptively reduce positions, increase cash reserves, or deploy hedging strategies, thereby providing portfolios the protection that pure return-focused models lack. Integrated into a broader multi-layer framework, a crash-detection layer strengthens resilience against tail risks while allowing other forecasting models to manage routine trading decisions.

- Volatility-Adaptive Horizon & Model Selection: Volatility is a defining feature of crypto markets, making adaptive modeling strategies essential for managing rapid price fluctuations. One common technique is the Exponentially Weighted Moving Averages (EWMA), which reacts quickly to shocks by assigning higher weight to recent return calculations. Similarly, GARCH family models capture volatility clustering and persistence (CAIA, 2024). Realized volatility measures, derived from sliding windows of high-frequency data, further enable real-time detection of shifts in market turbulence. Some approaches employ Markov regime-switching models, which adapt forecasts by switching between latent states (e.g. calm vs. turbulent) according to hidden probabilities (Agakishiev et al., 2025). In practice, this means that during calm periods an agent may rely on longer horizons, such as daily forecasts, while in high-volatility conditions it may shorten horizons and switch to models designed for turbulence.This adaptability mirrors human trader intuition, where strategies shift dramatically during periods of market stress. Empirical evidence confirms that volatility-aware switching frameworks outperform static single-model setups by reducing forecast errors and improving resilience across states.

- Performance-Based Dynamic Signal Unification: Given the wide range of forecasting models, combining their outputs through ensembles provides a powerful way to enhance reliability. Techniques such as the weighted-majority algorithm dynamically adjust the influence of each model based on recent performance, emphasizing currently effective models and down-weighting models misaligned with the current state (Mukherjee, Singhal, & Shroff, 2024). Conceptually, this layer acts like a committee of experts: each model casts a bullish, bearish, or neutral vote, and the agent acts only when there is sufficient consensus. Strong alignment yields confident, actionable forecasts, while disagreement signals uncertainty and may trigger no trade at all. This approach provides robustness by amplifying agreement, cancelling out idiosyncratic noise, and ensuring the system self corrects over time. The ensemble thus becomes context-aware and result-driven, adapting its internal weighting to reflect recent conditions while benefiting from the complementary strengths of diverse models. This design closely resembles the way human traders weigh multiple perspectives, but with the added benefit of automated, quantitative performance tracking.

- Trade Amount Optimization: Position sizing can be just as critical as forecasting direction in governing long-term portfolio outcomes. Simple rules such as fixed-percentage risk allocation (e.g., risking 2% of equity per trade) provide discipline and scalability. However, more advanced approaches aim to balance growth and protection. Though in practice it can be overly aggressive, the Kelly Criterion is a widely used mathematical formula, prescribing an optimal fraction of capital to invest based on win probability and payoff. Variations including fractional Kelly or Optimal-f can temper the aggressiveness risk associated with the Kelly Criterion (Wójtowicz & Serwa, 2024). Volatility Targeting aims to maintain a consistent level of portfolio volatility by adjusting exposure to risky assets based on changes in market volatility. CPPI (Constant Proportion Portfolio Insurance), on the other hand, focuses on capital protection by adjusting exposure based on the portfolio’s distance from a predefined floor. While both strategies involve dynamic allocation, volatility targeting manages risk through volatility control, whereas CPPI manages downside risk by preserving a capital floor (Bai et al., 2025). Simulation-based techniques add another layer of optimization. By using Monte Carlo simulations, an agent can test different sizing strategies under thousands of randomized market paths and use the Sharpe ratio as the benchmark for selecting the one that delivers the best risk-adjusted performance. In this way, trade amount optimization becomes an integrated execution engine, unifying mathematical rules with simulation-based validation to ensure that signals are converted into disciplined allocations that emphasize consistency, resilience, and risk-adjusted growth rather than raw returns.

Together, these seven layers illustrate the breadth of techniques available to address the inherent noise, volatility, and unpredictability of cryptocurrency markets. While each layer contributes unique strengths, whether through detecting structural risks, capturing event-driven signals, or optimizing capital allocation, no single method is sufficient to consistently outperform across all market states. This underscores the need for an advanced hybrid framework that unifies multiple complementary techniques into a cohesive system. By integrating machine learning forecasts, rule-based trade recommendations, sentiment-driven insights, and adaptive risk management, such a framework can leverage the advantages of each approach, offset their limitations and result in more resilient and intelligent trading agents in the crypto domain. To illustrate the overall design, Figure 1 presents Hybrid Edge Trading Schema, which depicts how diverse forecasting, risk management, and execution mechanisms converge into a unified architecture, with the trading agent serving as the central hub that orchestrates these layers into a coherent trading framework.

Hybrid Edge Trading Schema (HETS)

Figure 1: The Hybrid Edge Trading Schema, built for resilience, adaptability, and risk-aware performance in volatile crypto markets, consisting of a 7-layer architecture encompassing: Technical Indicators, providing interpretability and forecast alignment with trader-trusted metrics; Time-Series Forecasting Models, capturing short-term momentum in trading; News Event Sentiment Analysis, incorporating shifts in sentiment, triggered by news, social media, or unexpected events; Topology-Based Crash Identification, supplying early warning mechanisms to reduce drawdowns; Volatility-Adaptive Horizon & Model Selection, dynamically adjusting strategies as market patterns shift; Performance-Based Dynamic Signal Unification, amplifying consensus and suppresses noise through adaptive ensemble weighting; and Trade Amount Optimization, ensuring disciplined, risk-adjusted position sizing. Combined, these approaches form a cohesive architecture designed to deliver smoother returns, reduced risk, and greater adaptability than any traditional single pronged approach.

Strategic Gains for Adopting HETS for Crypto Forecasting and Trading

By designing trading agents using HETS, a portfolio can increase profitability, reduce risk exposure, and improve resilience across unpredictable market states. While no single model or trade strategy can fully eliminate losses, systems equipped with structural warning mechanisms can limit the impact of extreme events by triggering pre-emptive hedging or position reduction. Evidence from financial risk management literature demonstrates that early warning signals reduce the tail risk of large portfolio losses and help preserve capital during stress periods (Ciciretti et al., 2025) ensuring that catastrophic drawdowns do not wipe out long term gains.

Another major benefit of adopting the HETS is the integration of qualitative factors such as news and sentiment into quantitative transactional forecasts. Traditional technical and economic models rely heavily on historical price data, which often lags market-moving events. Incorporating real-time sentiment signals adds a forward-looking dimension by capturing shifts in investor mood or policy signals before they are fully reflected in asset prices. Research has consistently shown that sentiment extracted from social media and news headlines correlates strongly with trading volume and short term volatility (Saravanos & Kanavos, 2025). By embedding these qualitative signals into the decision pipeline, hybrid agents avoid the blind spots of purely data-driven systems and respond more effectively to market volatility.

Blending multiple signals with market state adaptivity further improves consistency and robustness. In volatile and non-stationary markets, no single forecasting method performs well across all conditions. Ensemble approaches that adjust signal weights based on recent performance allow the system to self-correct and adjust emphasis dynamically. This provides stability when markets are calm and flexibility when turbulence increases, reducing the likelihood of overfitting to outdated conditions. Academic work on adaptive ensembles confirms that performance-weighted models consistently outperform single predictors in dynamic environments (Sun, Qu, Zhang, & Li, 2025). For investors, this translates into steadier returns and fewer false signals as the system learns which models are most reliable under the current state.

Further, trade amount optimization ensures that forecasts and signals are executed with appropriate risk adjusted positioning. Strategies such as Kelly scaling, volatility targeting, and Sharpe ratio simulations enable agents to maximize growth in the long run while limiting downside risk. Portfolios that employ volatility managed allocation have been shown to deliver significantly higher Sharpe ratios as compared to unadjusted strategies (DeMiguel, Martín‐utrera, & Uppal, 2024).

It is expected that the collective benefits of HETS approach outweigh that of any traditional approach. Instead of relying on one incomplete method, HETS integrates structural protection, external awareness, adaptive learning, and disciplined execution. The result is a system that can generate more consistent profits, reduce the severity of losses, and adapt fluidly to the complex and rapidly changing environment of cryptocurrency markets. These contrasts are clearest when presented side by side. Single methods may perform well in narrow conditions but tend to fail when market shifts or shocks occur. HETS integrates crash detection, sentiment, ensemble blending, and trade optimization to create a steadier, more adaptive, and risk aware system, as summarized in the table below.

Traditional Approach vs. Hybrid Edge Trading Schema Approach

| Dimension | Traditional Approach | HETS Approach |

|---|---|---|

| Drawdown Control | Vulnerable to large losses during crashes; no structural safeguards | Crash identification layer provides early warning signals, reducing drawdowns and preserving capital |

| Use of Market Sentiment | Limited to no reliance on market sentiment signals | Full incorporation of market sentiment signals with other layers for improved forecasting |

| Signal Reliability and Unification | Unreliable performance during market state shifts | Ensemble blending and performance-based dynamic signal unification for more adaptive forecasting |

| Risk Management | Limited ability to balance growth and risk in volatile markets | Advanced trade amount sizing rules optimize returns and lower risks while maintaining smoother equity curve |

| Volatility Adaptation | The model and forecast horizon remain fixed and are often misaligned with volatility | Volatility-adaptive horizon/model selection dynamically adjusts prediction windows and changes models to better match current state |

| Performance Consistency | Inconsistent portfolio performance across market states | More stable portfolio performance across market states due to diversification of methods |

While the comparison makes clear that HETS offers distinct advantages over traditional methods, this approach is not without its own challenges. Its effectiveness depends on careful integration of diverse modules at each layer, alignment of data sources, and the ability to manage computational complexity without introducing excessive latency. Success therefore hinges on three factors: 1) robust validation to guard against spurious signals, 2) adaptive retraining to counter alpha decay, and 3) streamlined execution pipelines that can operate at the speed of live markets. When these conditions are met, HETS-compliant agents are expected to sustain consistent profitability and resilience where traditional methods often collapse under stress.

Conclusion

Crypto markets will likely remain volatile and rapidly evolving, but HETS offers a viable path to managing this complexity. For technical readers, the 7-layer architecture offers a path for orchestrating techniques such as ML, TDA, and ensemble learning into a coherent trading framework. For business stakeholders, HETS offers clear value: smoother returns in chaotic markets supported by built-in mechanisms to mitigate tail-risk events and preserve capital.

Nevertheless, this approach is not without limitations. Implementing such a framework requires substantial computational resources, real-time data infrastructure, and careful coordination across multiple models. Data quality remains a persistent challenge with noisy sentiment feeds and structural indicators yielding false positives if not carefully calibrated. Furthermore, while simulation and backtesting help evaluate strategies, overfitting to noise remains a critical risk. Without rigorous regularization and validation, complex models may end up fitting spurious patterns rather than true signals. In real world deployments, alpha decay is another concern, as predictive edges erode quickly in competitive markets, necessitating frequent retraining, adaptation, and turnover management. Latency bottlenecks can also undermine performance. Finally, unmodeled exogenous shocks, from regulatory interventions to sudden exchange failures, create error tails and reinforce the need for robust risk controls, conservative position sizing, and capital preservation mechanisms.

Looking ahead, several areas warrant further research. These include the integration of reinforcement learning agents for adaptive portfolio rebalancing the use of cross-asset spillover models to capture linkages between crypto and traditional financial markets, and the use of genetic algorithms to evolve more effective weighting schemes within ensemble models. Additionally, the application of explainable AI techniques could further enhance the interpretability of multi-agent frameworks.

While challenges remain, the HETS approach offers a compelling path forward for crypto forecasting and trading. By combining structural defense, qualitative insights, adaptive learning, and risk-optimized execution, such systems can help transform trading in one of the most turbulent yet opportunity-rich domains of modern finance.

ABOUT ENTEFY

Entefy is an enterprise AI software company. Entefy’s patented, multisensory AI technology delivers on the promise of the intelligent enterprise, at unprecedented speed and scale.

Entefy products and services help organizations transform their legacy systems and business processes—everything from knowledge management to workflows, supply chain logistics, cybersecurity, data privacy, customer engagement, quality assurance, forecasting, and more. Entefy’s customers vary in size from SMEs to large global public companies across multiple industries including financial services, healthcare, retail, and manufacturing.

To leap ahead and future proof your business with Entefy’s breakthrough AI technologies, visit www.entefy.com or contact us at contact@entefy.com.